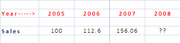

Market Observer, Summer 2008: Sheltcorp' sales went up 12.6% between 2005 and 2006. Now that its 2007 sales figures have been released, we can see that its sales in 2007 were 38.6% greater than its sales in 2006. Clearly, Sheltcorp has a winning formula and 2008 sales will be higher still.

Which of the following, if true, most seriously weakens the conclusion espoused above?

A. Sheltcorp' 2007 sales figures are preliminary and may change by upto 2% when the final figures are calculated.

B. In 2006 and 2007, at the annual trade show in January Sheltcorp released popular new products that increased Sheltcorp' sales figures for their respective years, but Sheltcorp did not release any new products at the 2008 trade show.

C. Sheltcorp offers a bonus to its employees based on annual sales.

D. The 12.6% increase in sales is the smallest annual increase seen in the past five years of Sheltcorp' history.

E. Economic forces, rather than individual company actions, are often the largest influence on annual sales figures.

source : Veritas Prep

OA soon

interesting CR

This topic has expert replies

- Stuart@KaplanGMAT

- GMAT Instructor

- Posts: 3225

- Joined: Tue Jan 08, 2008 2:40 pm

- Location: Toronto

- Thanked: 1710 times

- Followed by:614 members

- GMAT Score:800

The GMAT is written according to patterns; understanding those patterns and how the test works gives you a huge advantage over your competitors.buoyant wrote:Market Observer, Summer 2008: Sheltcorp' sales went up 12.6% between 2005 and 2006. Now that its 2007 sales figures have been released, we can see that its sales in 2007 were 38.6% greater than its sales in 2006. Clearly, Sheltcorp has a winning formula and 2008 sales will be higher still.

Which of the following, if true, most seriously weakens the conclusion espoused above?

A. Sheltcorp' 2007 sales figures are preliminary and may change by upto 2% when the final figures are calculated.

B. In 2006 and 2007, at the annual trade show in January Sheltcorp released popular new products that increased Sheltcorp' sales figures for their respective years, but Sheltcorp did not release any new products at the 2008 trade show.

C. Sheltcorp offers a bonus to its employees based on annual sales.

D. The 12.6% increase in sales is the smallest annual increase seen in the past five years of Sheltcorp' history.

E. Economic forces, rather than individual company actions, are often the largest influence on annual sales figures.

source : Veritas Prep

OA soon

Here, we're asked to weaken the argument. So, we need to break it down and determine what the author is assuming, then look for an answer that attacks that assumption.

The conclusion is that sales will be even higher in 2008. What's the evidence? That the company saw big increases in both 2006 and 2007.

What's the author assuming? That the increases in 2006 and 2007 are predictive of 2008.

Predictions are common conclusions on the GMAT. Whenever an author makes a prediction, she's assuming that relevant conditions will continue to hold true.

How do you weaken a prediction? Look for a relevant change in circumstances.

With that general prediction in mind, we can very quickly zoom in on (B), since that's the only choice that even compares 2006/2007 to 2008.

Stuart Kovinsky | Kaplan GMAT Faculty | Toronto

Kaplan Exclusive: The Official Test Day Experience | Ready to Take a Free Practice Test? | Kaplan/Beat the GMAT Member Discount

BTG100 for $100 off a full course

GMAT/MBA Expert

- Mike@Magoosh

- GMAT Instructor

- Posts: 768

- Joined: Wed Dec 28, 2011 4:18 pm

- Location: Berkeley, CA

- Thanked: 387 times

- Followed by:140 members

Dear buoyant,buoyant wrote:Market Observer, Summer 2008: Sheltcorp' sales went up 12.6% between 2005 and 2006. Now that its 2007 sales figures have been released, we can see that its sales in 2007 were 38.6% greater than its sales in 2006. Clearly, Sheltcorp has a winning formula and 2008 sales will be higher still.

Which of the following, if true, most seriously weakens the conclusion espoused above?

I'm happy to help.

First of all, here's a blog on weakening CR arguments:

https://magoosh.com/gmat/2012/how-to-wea ... reasoning/

A. Sheltcorp' 2007 sales figures are preliminary and may change by up to 2% when the final figures are calculated.

2% is not going to make a very big difference. This is not much of a weakener. This is not correct.

B. In 2006 and 2007, at the annual trade show in January Sheltcorp released popular new products that increased Sheltcorp' sales figures for their respective years, but Sheltcorp did not release any new products at the 2008 trade show.

This is promising. This certainly would account for vigorous sales in 2006 & 2007, but much less in 2008, the exact opposite of what the argument predicts.

C. Sheltcorp offers a bonus to its employees based on annual sales.

OK. That's nice, but employee bonuses are not going to account for much more than a tiny bit of the profits. This is simply not going to make a big difference. This is not correct.

D. The 12.6% increase in sales is the smallest annual increase seen in the past five years of Sheltcorp' history.

OK, that was a low point --- incidentally, not at all bad for a low point! Some companies would kill for 12% growth! Nevertheless, that was a low point, and it appears the are accelerating out of that --- that would be consistent with the argument, so it's not a weakener. This is not correct.

E. Economic forces, rather than individual company actions, are often the largest influence on annual sales figures.

Tempting, but too general. If we see a trend of increasing sales, maybe that's a trend with the company, or maybe that's a trend with the larger economy, but without further information, we have no reason to call the trend into question. This is not correct.

It would bring too much external information to recall the sub-prime mortgage crisis, the economic downturn, and worldwide recession in 2008. Yes, if we introduced that fact with the information in (E), that would weaken the argument, but that just brings in too much outside knowledge.

The best answer here is (B).

Does all this make sense?

Mike

Magoosh GMAT Instructor

https://gmat.magoosh.com/

https://gmat.magoosh.com/

Thank You Mike and Stuart for nice explanations!

What confuses me in this question is the "comparison between the sales figure of 2006 and 2007" in the given premise.

The premise says sales figure of 2007 was higher than that of 2006. Accordingly concludes that sales in 2008 will be higher than that in 2007.

Answer choice B simply says that popular new products were introduced by the company(both in 2006 & in 2007).Hence, sales increased in both 2006 and 2007. Doesn't it mean that the sale% in 2007 still remains 38.6% greater than that in 2006?

Am i missing something?

What confuses me in this question is the "comparison between the sales figure of 2006 and 2007" in the given premise.

The premise says sales figure of 2007 was higher than that of 2006. Accordingly concludes that sales in 2008 will be higher than that in 2007.

Answer choice B simply says that popular new products were introduced by the company(both in 2006 & in 2007).Hence, sales increased in both 2006 and 2007. Doesn't it mean that the sale% in 2007 still remains 38.6% greater than that in 2006?

Am i missing something?

- Stuart@KaplanGMAT

- GMAT Instructor

- Posts: 3225

- Joined: Tue Jan 08, 2008 2:40 pm

- Location: Toronto

- Thanked: 1710 times

- Followed by:614 members

- GMAT Score:800

Hi again!buoyant wrote:Thank You Mike and Stuart for nice explanations!

What confuses me in this question is the "comparison between the sales figure of 2006 and 2007" in the given premise.

The premise says sales figure of 2007 was higher than that of 2006. Accordingly concludes that sales in 2008 will be higher than that in 2007.

Answer choice B simply says that popular new products were introduced by the company(both in 2006 & in 2007).Hence, sales increased in both 2006 and 2007. Doesn't it mean that the sale% in 2007 still remains 38.6% greater than that in 2006?

Am i missing something?

One thing that it's very important to remember: we accept the evidence as true. It's not our job to discredit the evidence itself, but rather how the author uses that evidence. The vulnerable part of every argument is always the author's assumptions: the missing but necessary pieces of evidence.

So, we accept that sales increased in both 2006 and 2007. Our goal is to show that those increases aren't necessarily predictive of another increase in 2008. Since (b) tells us that something sales-inducing happened in both 2006 and 2007 - and that it didn't happen in 2008 - we have our winner.

Stuart Kovinsky | Kaplan GMAT Faculty | Toronto

Kaplan Exclusive: The Official Test Day Experience | Ready to Take a Free Practice Test? | Kaplan/Beat the GMAT Member Discount

BTG100 for $100 off a full course

- Abhishek009

- Master | Next Rank: 500 Posts

- Posts: 359

- Joined: Wed Mar 11, 2009 4:37 am

- Location: Kolkata, India

- Thanked: 50 times

- Followed by:2 members

buoyant wrote:Market Observer, Summer 2008: Sheltcorp' sales went up 12.6% between 2005 and 2006. Now that its 2007 sales figures have been released, we can see that its sales in 2007 were 38.6% greater than its sales in 2006. Clearly, Sheltcorp has a winning formula and 2008 sales will be higher still.

Which of the following, if true, most seriously weakens the conclusion espoused above?

So our target is to attack the red highlighted part.

A. Sheltcorp' 2007 sales figures are preliminary and may change by upto 2% when the final figures are calculated.

Not relevant to the present discussion.

B. In 2006 and 2007, at the annual trade show in January Sheltcorp released popular new products that increased Sheltcorp' sales figures for their respective years, but Sheltcorp did not release any new products at the 2008 trade show.

Seems good , lets keep it for further consideration..

C. Sheltcorp offers a bonus to its employees based on annual sales.

Irrelevant to the present context.

D. The 12.6% increase in sales is the smallest annual increase seen in the past five years of Sheltcorp' history.

Might be , but how can we weaken the conclusion from this statement ...

We accept , that the minimum increase in sales is 12.36%, in 2008 increase in sales may be 20% satisfying the criteria given in this statement , but we can't weaken the conclusion from this statement..

E. Economic forces, rather than individual company actions, are often the largest influence on annual sales figures.

Nothing new about it , everyone knows it , it seems just a casual comment on an issue , this statement lacks fire to attack the conclusion , hence rejected..

Among the given options , IMO (B) seems best...[/img]

Abhishek

GMAT/MBA Expert

- Mike@Magoosh

- GMAT Instructor

- Posts: 768

- Joined: Wed Dec 28, 2011 4:18 pm

- Location: Berkeley, CA

- Thanked: 387 times

- Followed by:140 members

Dear buoyant,buoyant wrote:Thank You Mike and Stuart for nice explanations!

What confuses me in this question is the "comparison between the sales figure of 2006 and 2007" in the given premise.

The premise says sales figure of 2007 was higher than that of 2006. Accordingly concludes that sales in 2008 will be higher than that in 2007.

Answer choice B simply says that popular new products were introduced by the company(both in 2006 & in 2007).Hence, sales increased in both 2006 and 2007. Doesn't it mean that the sale% in 2007 still remains 38.6% greater than that in 2006?

Am i missing something?

I'm happy to respond to this. I see Stuart already responded about the appropriateness of choice (B). I just want to address your question about the issue you see in the premise.

I don't know how much experience you have in marketing and sales. Perhaps you are very familiar with this field, but if you aren't, it's worthwhile to get more familiar with it, because knowledge of how these fields work can, in some instanced, form part of the background knowledge that the GMAT CR expects you to know.

Let's say,

In 2005, Sheltcorp sold products {A, B, C, D, E}

In 2006, they introduced product F, so at that point, they sold {A, B, C, D, E, F}. This expanded sales base accounted for the 12.6% sales increase from 2005 to 2006.

In 2007, they introduced products G & H, so at that point, they sold {A, B, C, D, E, F, G, H}. This expanded sales base accounted for the 38.6% sales increase from 2006 to 2007.

So, yes, sales continued to increase over these years, because they kept introducing new products. As a general rule, when a company introduces a new product, it hopes that consumers will keep buying all of its old products as well as the new product, which will result in an increase in revenue. There are rare cases (e.g. Apple) in which almost every new product is an upgrade or replacement for a previous product, but that is not standard throughout business.

The flaw of the argument is to assume that the trend will continue, and (B) points out this flaw.

Does all this make sense?

Mike

Magoosh GMAT Instructor

https://gmat.magoosh.com/

https://gmat.magoosh.com/